London Square Mile. The modern British Empire

London Square Mile

When we think of the heart of the United Kingdom, it’s impossible not to picture London. Beyond its iconic landmarks and historical grandeur, London is much more than a cultural and political capital. London square mile is the nerve centre of a global empire no longer defined by colonies and battleships but by finance and influence.

The City of London, often referred to as the London Square Mile, is the true powerhouse behind Britain’s enduring dominance on the world stage. While the British Empire may have formally ended, the financial empire that operates from the City of London remains a force unparalleled in its reach and sophistication.

The Square Mile holds a unique position as the world’s financial capital, shaping the global economy through its vast network of banks, brokers, and financial institutions. Unlike traditional governments, which wield power through legislation and force, the City of London operates in the shadows, pulling the strings of the global economy with precision and expertise.

Its influence is both immense and discreet facts that many people outside the financial world fail to fully appreciate.

A Modern Empire in Disguise

Although the sun has set on Britain’s colonial empire, the City of London has found new ways to retain global dominance.

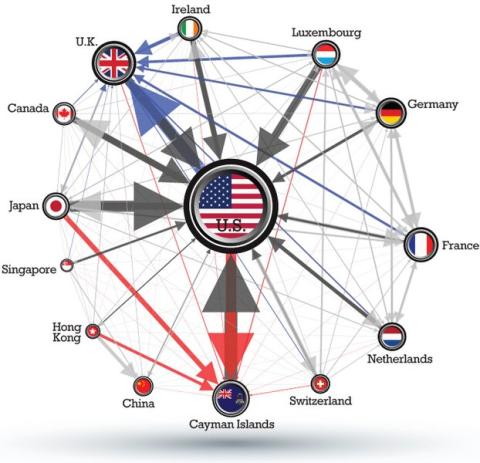

One of its primary tools is its control over offshore financial centres, often referred to as tax havens.

These zones, many of which are tied to Britain through historical and legal connections, include territories like the Cayman Islands, Jersey, and Bermuda. Combined, these offshore networks manage over $11 trillion in assets, providing wealthy individuals and corporations a place to park their money far from the prying eyes of regulators and tax authorities.

It is here, in these opaque havens, that the City thrives. London’s financial institutions facilitate trillions of pounds in transactions that flow through these offshore zones annually.

A 2020 report from Tax Justice Network estimated that the UK and its overseas territories account for over a third of global tax abuse, with much of this routed through London.

High-profile scandals like the Panama Papers leak highlighted the City’s role in managing and legitimising wealth of dubious origins. Russian oligarchs, Gulf monarchs, and even Western elites have all relied on the City to quietly integrate their fortunes into the global financial system. The system is designed to remain elusive, and this elusiveness is where the City’s power lies.

Independence and Influence

London Square Mile - The City of London’s extraordinary autonomy is another key to its success. Unlike any other part of the UK, the Square Mile is governed by its own ancient laws and customs.

It operates almost as a state within a state, with its own flag, coat of arms, and ceremonial leader, the Lord Mayor of London.

Remarkably, the British monarch is not allowed to enter the City’s territory in their official capacity without the permission of the Lord Mayor. Even the Bank of England, central to the nation’s monetary policy, operates with a degree of independence unique to its relationship with the City.

Established in 1694, the Bank of England was initially created as a private institution to finance wars. Today, its independence remains a cornerstone of the financial system, but its autonomy also shields it from direct government control.

The role of the Lord Mayor, though largely ceremonial today, reflects the City’s historical significance. Acting as a global ambassador for financial services, the Lord Mayor represents the enduring influence of the Square Mile.

This unique arrangement ensures that the City operates with unparalleled flexibility, allowing it to respond to economic challenges faster than any government body could.

The Legacy of the Rothschilds

No discussion of the City’s influence would be complete without mentioning the Rothschild family.

As one of the world’s most powerful banking dynasties, the Rothschilds played a pivotal role in shaping London’s financial landscape in the 19th century. From financing wars to establishing international banking norms, their legacy is woven into the fabric of the City.

Today, while the direct influence of the Rothschilds has diminished, their methods and networks remain foundational to how the City operates.

Their mastery of financial innovation and international connections exemplify the principles that keep London at the forefront of global finance.

Resilience in a Changing World

What sets the City of London - London Square Mile apart from other financial hubs is its extraordinary resilience.

While nations like the United States rely heavily on the dominance of the dollar, the City’s strength lies in its adaptability.

Even if the dollar were to collapse as the world’s reserve currency, the City would continue to thrive by facilitating global transactions and trade.

The Square Mile has weathered centuries of change, from the collapse of the British Empire to the financial crises of the 20th and 21st centuries.

Its ability to pivot and innovate has ensured that it remains a cornerstone of the global economy.

In a world increasingly driven by technology, the City has embraced fintech, cryptocurrency, and green finance, ensuring its relevance for decades to come.

A Modern Financial Empire

The City of London - London Square Mile is not just a relic of the past—it is the embodiment of Britain’s modern empire. Its power doesn’t rely on territory but on influence, strategy, and the ability to profit from global transactions.

As global currencies shift and economic alliances evolve, the Square Mile stands firm as a beacon of financial ingenuity.

Whether it’s through managing offshore wealth, adapting to technological advances, or navigating geopolitical upheavals, the City of London continues to define what it means to be a financial superpower. Its wisdom lies in its ability to endure, no matter what storms the global economy may face.

The Square Mile remains the undisputed heart of global finance— a testament to Britain’s enduring role in shaping the world.