The cost of living crisis in the UK. Will 2025 mark the end of our nightmare?

The cost of living crisis in the UK

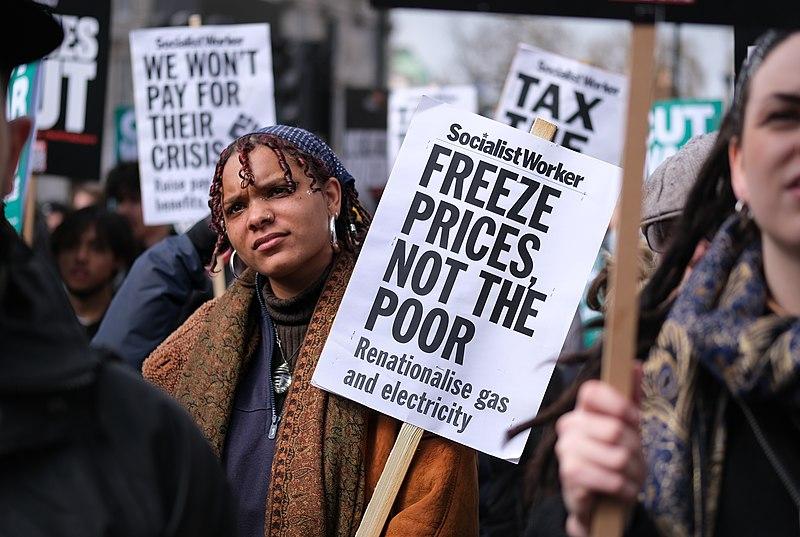

Britons are exhausted. The soaring cost of living, a housing crisis, and an unrelenting energy burden have pushed millions of families to the brink. Despite the government’s rosy forecasts, people across the country are asking: will the measures in place be enough to ease the strain, or is this just more political hot air?

Inflation: A Mirage or a Genuine Lifeline?

The Bank of England predicts inflation will fall to 2.75% in 2025, with even lower figures from the OECD and OBR.

On the surface, this looks like a breakthrough, but for millions of Britons, these numbers mean little.

Stabilised inflation doesn’t roll back prices, leaving households stuck with sky-high bills.

Lisa Clarke, a single mother of two from Manchester, explains: “I used to spend £50 a week on groceries for my family.

Now it’s £90. Stabilisation doesn’t mean those prices are dropping.

For families already on the edge, the government’s optimism feels like a cruel joke.

The Human Cost: When Will Suffering End?

Forget spreadsheets and jargon—this is life on the ground.

Food banks are bursting into the seams, with demand higher than ever. Nearly half of UK households are struggling to make ends meet, and for some, the choice between heating their home and feeding their children is a daily reality.

The housing market is an unrelenting beast. London rents have soared past £2,500 a month, forcing families into cramped and unsafe living conditions. For those dreaming of homeownership, rising interest rates have crushed any hope.

“Every month, I have to choose whether to pay my rent or buy my daughter’s asthma medication,” says Sarah McMillan, a nursery worker from Birmingham. “I feel like I’m failing her.”

This isn’t just a crisis, it’s a national scandal.

Government Promises: Lifeline or Lip Service?

The government claims it’s got a plan, but how much of it will truly help those in need?

Tax reforms will abolish non-domiciled tax benefits from April 2025, theoretically boosting revenue for public services. However, critics say this is too little, too late for struggling households The National Minimum Wage increase to £12.21 per hour is welcome, but many workers fear it’s not enough to combat rising rents and bills.

“It barely covers rent, let alone food,” says James Patel, a hospitality worker in London Social benefits will rise by 6.7%, but with inflation already wreaking havoc on family budgets.

This will make a real difference Initiatives to boost business, such as raising the VAT threshold and investing in green tech, aim to create jobs, but experts warn these policies may take years to deliver results.

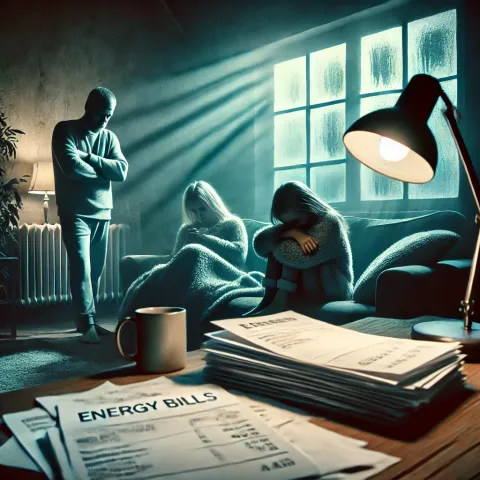

Energy Bills: Why Are We Paying the Price?

Energy bills remain a national nightmare.

The removal of government subsidies has plunged families back into financial chaos.

While renewable energy projects promise long-term solutions, they do nothing to solve the immediate crisis.

The government has committed £2 billion to wind and solar projects, with plans for modular nuclear reactors to improve energy security.

Windfall taxes on energy firms are being used to fund discounts for low-income households, but for families like the Turners in Newcastle, these promises feel far away.

“We’re drowning now,” says Adam Turner. “Promises about wind farms don’t stop the bills piling up on my kitchen table.”

Jobs and Automation: Fighting an Uncertain

Future Unemployment may be holding steady at 4.2%, but automation and underemployment are reshaping the workforce in unsettling ways.

Many workers fear being left behind as industries adapt to technological change.

The government has pledged to invest over £1 billion in upskilling workers in growth sectors like tech and green industries.

Protections for gig economy workers, including minimum earnings guarantees, are also on the horizon.

While these measures show promise, they feel like long-term fixes for a crisis that needs immediate action.

Why France and Germany Are Beating Us at Protecting Their People

While Britons struggle, our European neighbors have taken bold steps to ease the burden on their citizens.

Germany has capped energy prices, while France has issued direct cash payments to vulnerable households.

Critics of the UK government argue that Britain’s cautious fiscal approach has left families to fend for themselves.

“Why can’t we have what Germany and France offer?” asks Sarah McMillan.

“We’re paying the price for their inaction.”

Will 2025 Be the Turning Point?

Optimism for 2025 feels shaky at best. Inflation is slowing, wages are rising, and initiatives are beginning to take root, but systemic challenges like housing costs, energy bills, and global economic instability cast a long shadow.

“I just want to feel safe again, like I can provide for my kids,” says Lisa Clarke. “Right now, it feels impossible.”

For families across the UK, this isn’t about thriving, it’s about surviving another day. Act Now or Risk It All There is hope on the horizon. Investments in renewable energy, wage growth, and social support suggest a brighter future.

Even small wins—a lower bill or a pay rise—can change lives. But these promises must turn into action, and action must deliver results.

The government is out of time. If it fails to act decisively, the nightmare of Britain’s cost-of-living crisis will stretch far beyond 2025.

The clock is ticking. Britain cannot afford to wait.