Five reasons to invest in London real estate amidst the impending market crash of 2025

Why London Still Matters We’ve all seen the headlines: “Market Crash Incoming,” “Interest Rates Soaring,” “Real Estate Chaos Ahead.” It’s enough to make anyone pause. But here’s the thing—while others hesitate, savvy investors know that uncertainty often breeds opportunity. London isn’t just a city; it’s a survivor.

Through wars, recessions, and global upheavals, this city has always come out stronger. In 2025, despite all the noise, London’s real estate market remains one of the safest and smartest bets you can make. Let’s explore why.

Reason 1: London’s Role as a Global Financial Hub

London isn’t just the UK’s capital—it’s the centrepiece of global commerce. The London Stock Exchange, multinational headquarters, and an ever-expanding tech scene ensure that the city’s economy stays dynamic.

Why This Matters to You

Even during economic downturns, areas like Mayfair, Chelsea, and the City of London retain their appeal. A 2024 report from the Office for National Statistics revealed that London received 35% of all foreign direct investment in UK real estate. Here’s the thing: while Manchester and Birmingham are gaining attention, they can’t rival London’s global pull. This isn’t just a place for locals; it’s where the world comes to do business.

Reason 2: Limited Supply = Protected Prices

London has a unique problem (or opportunity, depending on how you see it): there’s simply not enough room to build. Strict planning laws and limited land keep supply in check, which acts as a buffer against price drops.

The Numbers Tell the Story

Liverpool approved over 10,000 new residential units in 2024, leading to concerns about oversupply. London, by contrast, saw fewer than 2,000 approvals in prime central areas, maintaining its scarcity value. What does this mean for investors? Stability. London’s supply demand dynamic helps protect property values even when the wider market wobbles.

Reason 3: A Diverse Tenant Pool

Here’s a less obvious reason: the people who rent properties in London. From international students to professionals in finance, tech, and law, the city’s tenant base is as diverse as its economy.

Why Diversity Reduces Risk

Let’s take Shoreditch and Hackney. These areas have become hubs for tech workers, driving demand for sleek, modern flats. Meanwhile, affluent expats and students flock to Chelsea and South Kensington, creating steady demand for high-end rentals. Compare that to cities like Sheffield, where student housing dominates the rental market. If one sector falters, the impact is felt across the city. In London, that risk is spread across multiple demographics, keeping rental yields stable.

Reason 4: Government Support You Can Count On

The UK government has a history of supporting the housing market, and London often benefits the most.

From Help to Buy to incentives for green building projects, these initiatives ensure demand remains strong.

What’s Next? A Green Revolution?

There’s talk of expanding tax breaks for eco-friendly properties. If this happens, energy-efficient homes could see a 15% boost in value over the next two years. For investors, this represents both an ethical and profitable opportunity.

Reason 5: Resilience in Times of Crisis

London doesn’t just survive crises—it thrives after them. From the financial crash of 2008 to Brexit and the pandemic, this city has consistently proven its ability to recover faster than others.

Quick Fact

A 2023 Savills report found that prime central London properties bounced back 15% faster than the national average after the pandemic. History shows us that London isn’t just a good investment during stable times—it’s a smart bet when the going gets tough.

What Are the Risks? Let’s Be Honest

No investment is without risks, and London real estate has its share. High costs: Buying into London’s market requires significant capital. Rising interest rates: Borrowing has become more expensive, which could cool demand.

Speculative luxury developments: High-end properties may see slower growth compared to mid-market homes. With the right strategy, these risks can be managed. And the potential rewards? They speak for themselves.

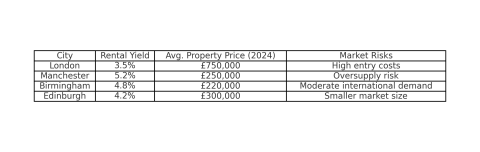

Comparing London to Other UK Cities

London’s figures make one thing clear: while yields might be higher in other cities, London offers unmatched stability and capital appreciation potential.

Practical Advice for Investors

Go for prime locations: Neighbourhoods like Notting Hill, Kensington, and Marylebone are safe bets.

Diversify your portfolio: Don’t just focus on residential properties— consider commercial spaces too. Keep an eye on green trends: Energy-efficient properties are the future. Do your homework: Use trusted resources like Zoopla, Savills, and Rightmove.

The uncertainty of 2025 might feel intimidating, but London remains a city of opportunities. Its unique mix of resilience, global appeal, and limited supply ensures that it will continue to reward those who invest wisely. So, is London still worth it?

Absolutely. And if you make your move now, you could position yourself for extraordinary returns in the years ahead.