Affordable housing in the UK: find the best regions and save

Finding affordable housing in the UK

Finding affordable housing in the UK can feel like solving a riddle.

With house prices soaring and rents climbing higher, it’s no wonder so many feel stuck.

But here’s some hope: solutions do exist. Through personal insights and practical advice, this article explores where to live, what help is available, and how to make your housing budget go further.

The best regions to rent in the UK

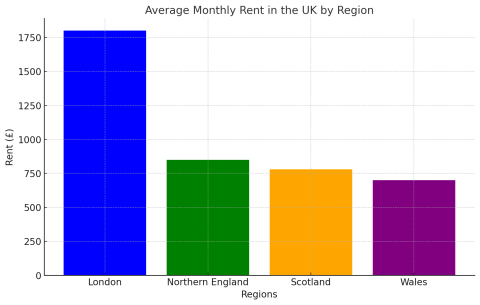

When people think of renting in the UK, London often steals the spotlight—for better or worse. But beyond the capital, there are regions where renting is more affordable and the quality of life is better.

Northern England: a hidden gem

Cities like Manchester and Leeds are not just affordable but also thriving.

Example from experience: Emily, a friend I spoke to recently, moved from London to Leeds and couldn’t believe the difference.

“I went from paying £1,400 for a tiny flat to £850 for a spacious, sunny apartment. It’s like I can finally breathe again,” she told me.

Scotland: affordable and tenant-friendly

Affordable housing in the Glasgow and Dundee have been winning renters over for years, not only because of lower costs but also due to Scotland’s tenant protections.

Did you know that in Glasgow, the average rent is £780? That’s far below what you’d pay in Edinburgh or even smaller southern cities.

Reflection: A colleague who rented in Glasgow for two years often said, “Living here feels like the housing market actually works for people. It’s not perfect, but at least you feel supported.”

Wales: where savings meet scenery

From Cardiff to Swansea, Wales combines affordability with an unmatched sense of community. Rural areas, in particular, offer even greater savings while keeping you connected to urban hubs.

Programs for first-time buyers

If you’re looking to buy, it’s easy to feel disheartened. But there are real opportunities if you know where to look.

Help to buy equity loan

The Help to Buy program gives you a loan of up to 20% of the property’s value (40% in London), making it easier to secure a mortgage.

- Example: Oliver, a graphic designer, described how the scheme transformed his life. “I didn’t think I’d ever afford a home, but the equity loan made it manageable. Now I have a place I can truly call mine.” Learn more here.

Shared ownership

Shared ownership is ideal for those who can’t afford a full deposit but want to start building equity.

- Cautionary note: A housing advisor I once spoke to said, “Shared ownership is great, but always read the fine print—hidden costs can creep up on you.”

First Homes scheme

This initiative offers discounted homes to first-time buyers in essential professions, like teachers and healthcare workers.

- Personal touch: One nurse I met shared how the scheme helped her move into her dream home. “It felt good knowing this was designed for people like me,” she said. Details here.

Tips to save on rent

Even in expensive regions, there are ways to make renting more manageable.

Co-housing communities

Living in co-housing offers the perfect balance between privacy and community. These setups often reduce costs and foster supportive living environments.

Negotiate with landlords

This one works more often than you’d think. A friend once managed to lower her rent by offering to sign a longer lease. Her landlord appreciated the stability, and she saved £50 a month.

Explore rent-to-own schemes

These agreements are still rare in the UK, but they’re worth considering if you’re renting long-term. Rent-to-own lets a portion of your rent contribute toward buying the property.

The bigger picture: solving the housing crisis

Rental prices have shown a steady increase over the past years, and projections suggest this trend will continue.

Below is a chart illustrating the growth of rental prices in London and Northern England from 2018 to 2025

It’s tempting to view housing as purely financial, but it’s much more. It’s about belonging, stability, and opportunity.

- Build more social housing: Local councils need funding and support to expand affordable housing options.

- Offer landlord incentives: Tax benefits for setting reasonable rents could stabilize the market.

- Introduce smarter tech: Platforms that provide detailed rental trends and tenant rights could empower renters.

Final thoughts

Housing isn’t just about finding a roof over your head—it’s about creating a life.

Whether you’re renting or buying, the path isn’t always easy, but it’s worth walking.

Take advantage of the resources available, and don’t be afraid to ask questions or seek help.

Your home is out there—sometimes, it’s just waiting for you to find it.