The Week That Shaped the World 25 April – 2 May 2025

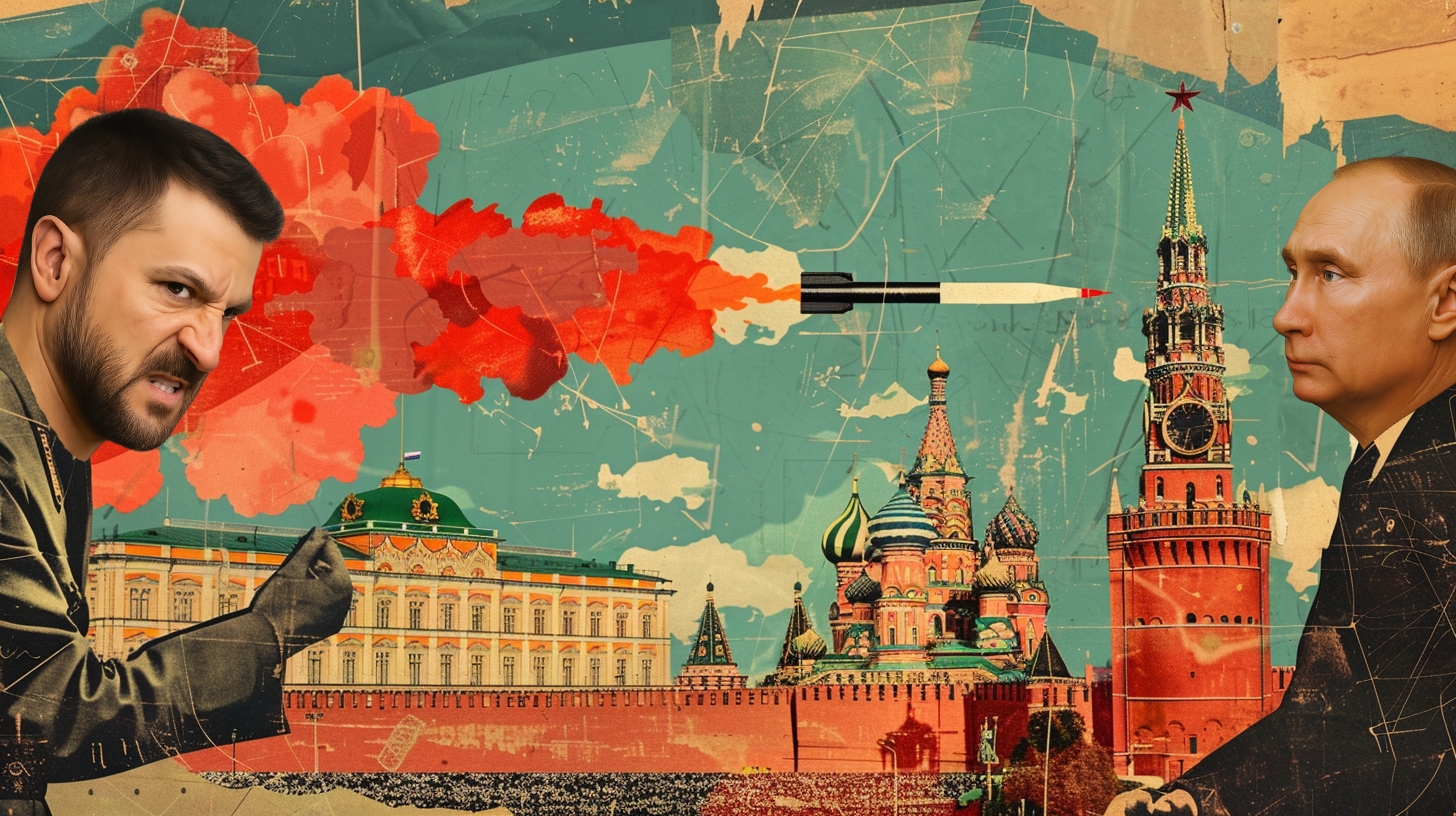

1. Zelensky’s May 9 Warning: The Message Beneath the Missile

It was a short remark, delivered without theatrics. But it didn’t take long for it to echo. This week, Ukrainian President Volodymyr Zelensky said his military might not rule out a strike on Russian territory on 9 May, the day of Moscow’s annual Victory Day parade.

No specifics were offered. No threats, no red lines — just a quiet signal that the war may no longer pause for dates on the Russian calendar. The comment unsettled more than just Moscow. Victory Day, for many Russians, is not simply a celebration — it’s a ritual. And rituals, by nature, assume predictability.

Zelensky’s position was framed as a response to Russia’s ongoing missile attacks on Ukrainian cities. “The war doesn’t stop,” he said. “So why should we?” That line — unscripted or not — hit a nerve. Russia called the statement “a direct provocation.” Diplomats from neutral and allied states urged caution.

Some of those diplomats may be attending the parade themselves. Representatives from China and India are expected to be in Red Square — not to support the war, officially, but to maintain appearances. That fact alone may be what made Zelensky’s words land with such weight.

Whether anything happens on 9 May is still unknown. But the moment revealed something deeper: the conflict isn’t just fought with drones and artillery — it’s now intersecting with symbols. With memory. With performance.

And when that happens, even silence becomes strategic.

“When even a national holiday becomes a calculated risk, it’s a sign the war is no longer just on the ground — it’s in the calendar.”

2. Local Elections in England: Reform UK Finds an Opening Where Others Left a Gap

This week’s local elections didn’t bring a political earthquake — but the ground definitely shifted. Reform UK, led by the ever-returning Nigel Farage, made notable advances across parts of England long considered safe territory for the two major parties. It wasn’t a landslide. It didn’t need to be.

In towns like Doncaster and coastal seats along Lincolnshire, Farage’s party took enough votes to remind both Labour and the Conservatives that the political centre isn’t holding — it’s leaking. Labour kept its lead, but with signs of wear. And the Conservatives? The less said about their numbers, the better.

The bigger story here isn’t just who won or lost, but how voters are tuning out the traditional pitch. Reform UK isn’t offering policies so much as posture — a kind of angry plain-speaking that doesn’t explain much, but doesn’t need to. When frustration does the talking, clarity isn’t always required.

At Labour HQ, the line was that everything’s “moving in the right direction.” Perhaps. But that direction includes a rising populist current, and it’s no longer flowing quietly beneath the surface. Reform isn’t winning elections — yet. But it is winning arguments in places where people feel heard only at election time and forgotten the week after.

“Politics doesn’t like a vacuum. Sooner or later, someone steps in — not with answers, just with a louder voice and fewer doubts.”

3. Britain and Nigeria Sign Anti-Fraud Pact — But Is It More Than Optics?

This week, the UK and Nigeria agreed to work more closely on cracking down on financial crime. Joint investigations, shared data, more training — the usual list. It sounds solid on paper, and maybe it is. But in practice? Well, that's always a longer story.

For the UK, it’s a way to show it's building meaningful partnerships beyond Europe — a post-Brexit ambition still looking for traction. Nigeria, in turn, is trying to reframe its global image — not as a source of digital scams, but as a regional power taking financial crime seriously. There’s logic in that. There’s also history.

London’s financial institutions haven’t exactly covered themselves in glory when it comes to due diligence. Dirty money has passed through the City’s corridors with alarming ease, often hiding behind shell companies and polite silence. Nigeria, for its part, has struggled with enforcement at home — courts move slowly, and political pressure rarely helps.

Still, the agreement might matter. These things often start with symbolism — a handshake, a photo, a press release. What matters is whether the momentum continues once the cameras are gone.

“You can sign all the memorandums you like, but fighting fraud takes more than a headline. It takes patience, teeth — and a lot less hypocrisy.”

4. U.S. and Ukraine Sign Strategic Minerals Deal — Quiet Moves, Big Implications

It didn’t make front pages — but maybe it should have. This week, Ukraine and the United States signed an agreement on critical minerals. Lithium, cobalt, rare earths — the stuff that powers electric cars, phones, missiles, and the unspoken arms race of the modern economy.

On paper, it’s a win-win. Ukraine gets investment and access to U.S. tech supply chains. The U.S. gets a new source of materials it would very much prefer not to keep buying from China. But beyond the bullet points, this deal marks a quiet shift in how the two countries see each other.

For Ukraine, the message is: we’re not just asking for weapons — we’re part of your future. For the U.S., it’s a deeper tether: you don’t just support Ukraine’s survival, you’re now tied to its raw materials. That’s no longer just geopolitics — that’s business.

Of course, there’s a risk. The war is far from over, and no one can say how stable any of this will be in a year. And yet, the logic is clear: better to lay the tracks now than wait for the next derailment. China has a head start, but the West is finally reading the same map.

Deals like this don’t feel dramatic when they’re signed. But a year later, they’re often where the real movement started.

“Not all battles are fought with bullets. Some are drawn in contracts — and they last much longer.”

5. Iran’s Presidential Race Begins — and the Region Holds Its Breath

There wasn’t much fanfare. No fireworks. Just a quiet list of names — vetted, approved, and made official by Iran’s Guardian Council this week. Among them: a former central bank chief, a couple of establishment moderates, and the usual cohort of hardline clerics. It’s not the lineup that grabs headlines. It’s the context that matters.

The election is set for June. But in truth, it began long before that — in the streets of Tehran, in the wreckage of Gaza, and in the corridors of negotiation rooms that haven’t been visited in months. What’s at stake is not just Iran’s leadership, but the shape of the region’s next chapter.

The outgoing president, Ebrahim Raisi, leaves behind an uneasy legacy — economic strain, conservative entrenchment, and rising tensions with the West. Whoever takes his place will face an unenviable mix of internal pressure and external isolation. And yet, the structure remains familiar: the Supreme Leader still rules, and elections still offer only as much change as the system allows.

Still, diplomats are watching closely. A moderate victory could nudge Iran back toward the nuclear table — or at least reopen the conversation. A hardliner win could mean a deeper turn inward, or a sharper posture abroad. In either case, the Middle East doesn’t get to look away.

Elections in Iran don’t always shift policy. But sometimes, they shift perception. And that’s often what drives the next policy anyway.

“In Iran, politics isn’t always about who wins — it’s about what the world thinks the result might mean.”

6. U.S. GDP Shrinks in Q1 — And the Blame Game Begins

The numbers came in, and they weren’t good. The U.S. economy contracted by 0.3% in the first quarter of 2025 — the first drop in more than a year, and one that’s already sparked a round of finger-pointing. The White House says it’s a blip. Markets aren’t quite so sure.

President Trump, never shy about assigning credit or blame, insisted the contraction was “temporary turbulence” caused by inherited policies. Former officials from the Biden era, predictably, said the downturn was due to Trump’s own aggressive tariffs. And somewhere in between, economists tried to make sense of it all with graphs that nobody in Congress will read.

Behind the headlines, it’s a familiar story. Imports surged, exports dropped, and business investment slowed down — all under the weight of a trade agenda that looks more 1985 than 2025. What’s new is the tone: a sense that even the usual fixes might not work this time.

On Wall Street, the reaction was muted but watchful. The Dow dipped slightly, the dollar wobbled, and gold crept upward — the usual signs of investors hedging their bets. But the bigger question is political: can Trump sell a shrinking economy as strength in disguise?

That depends on whether people feel it. So far, job numbers are holding up. But if that changes — if paychecks shrink or prices spike again — the mood could turn fast. Economic pain is like a slow leak. It doesn't need to explode to make a mess.

“You can argue over the steering wheel, but if the engine stalls, no one cares who picked the music.”

7. U.S. Inflation Hits 3.6% — and the Fed’s Tightrope Gets Thinner

The Fed wanted breathing room. What it got instead was another jolt. New data this week showed U.S. inflation ticking up to 3.6%, with the core PCE — the figure the Fed actually watches — coming in at 3.5%. Neither number is catastrophic. Both are inconvenient.

The rise complicates what was already a delicate balancing act. Markets had priced in at least one rate cut this summer. Now, those bets are being quietly walked back. Jerome Powell, who has spent most of 2024 threading needles, is suddenly back to juggling flaming torches — in full view of a White House that would really prefer lower borrowing costs before November.

The politics are as sticky as the prices. Republicans accuse the Fed of dragging its feet. Democrats warn that a rate hike would strangle recovery. And Powell — caught between pressure and principle — keeps repeating that rates will move “as the data dictate.” A phrase that now sounds more like a shield than a strategy.

Meanwhile, the usual suspects are feeling it first. Food prices have inched back up. Rent is stubborn. Services inflation — the slow, grinding kind — continues to gnaw at household budgets. For working families, the “soft landing” promised last year feels more like turbulence with no ETA.

The question is no longer whether inflation is under control. It’s whether trust in the process of controlling it is still intact.

“You can adjust the rate, massage the language, and blame the weather — but if people feel squeezed, the numbers start to lose meaning.”

8. Bank of Japan Holds Rates — But Lowers the Lights on Growth

Some central banks make noise. Others blink. This week, the Bank of Japan did the latter — keeping interest rates unchanged, but quietly cutting its growth forecast for 2025 and 2026. No drama. Just a downward revision that landed heavier than it looked.

The message? Weak domestic demand, falling exports, and a currency that still can’t find its footing. Japan’s economic recovery — already cautious — now looks a bit more fragile, a bit less patient. And in a global environment rattled by tariffs and tightening, fragility tends to travel.

The yen, predictably, softened. Investors sought shelter — in dollars, in gold, in fewer assumptions. Markets didn’t panic, but they did what they always do when Tokyo whispers something uneasy: they listened very carefully.

Part of this is structural. Japan’s economy isn’t designed for volatility. It's built on endurance, not speed. But endurance still needs fuel — and right now, fuel costs more, wages are flat, and trade is no longer a predictable engine.

The BoJ faces an old dilemma with a new face: keep rates low to support growth, or tighten to defend the currency and contain imported inflation. This time, they chose to wait. Not out of conviction — but because no move felt safe enough.

And that, more than anything, may be the signal worth watching.

“Sometimes in central banking, saying nothing loudly is the only move left.”

9. SPACs Are Back — Because Why Learn the Lesson the First Time?

Just when you thought they were gone, they returned — quietly, cautiously, and with new suits. SPACs, the once-booming blank-cheque companies that fuelled market euphoria back in 2020–21, made a notable comeback in April: 16 new filings, 11 actual launches, and a fresh wave of interest from investors with short memories and long spreadsheets.

The logic hasn’t changed much. Traditional IPOs are still slogging through regulatory muck and investor fatigue. SPACs offer something faster, looser, and — for some — more exciting. You raise the money first, find the target later, and hope that somewhere along the line, everyone gets paid.

To be fair, this round looks a bit more sober. Many of the new vehicles are focused on specific sectors — clean tech, biotech, AI infrastructure — rather than chasing “the next Uber.” Underwriting is quieter. The marketing is dialled down. But make no mistake: the same DNA is there.

What’s changed is the tone. After the 2022 burnouts — failed mergers, class-action lawsuits, and a trail of disappointed retail investors — SPACs fell out of favour fast. Now, they’re being rebranded as “targeted capital conduits” or “accelerated acquisition vehicles.” Which is Wall Street code for: “let’s try this again, but with better fonts.”

Will it work? Maybe. Markets like a comeback story — until they don’t. The question is whether this new wave of SPACs is built on actual value… or just fancier language for the same old speculation.

“Every financial cycle has its favourite disguise. SPACs just changed the haircut, not the act.”

10. Two-Thirds of Americans Say They’re Behind on Savings — and Losing Ground

It didn’t come from Wall Street, but it may say more about the economy than any quarterly report. A new survey showed that 67% of Americans believe they’re falling behind on their savings goals, and nearly half don’t think they’ll ever catch up. Not because they’re reckless — but because the maths no longer adds up.

The report, from Bankrate, points to rising costs, stagnant wages, and growing uncertainty as the main culprits. People aren’t spending wildly — they’re just trying to stay afloat. Rent, childcare, food — everything costs more. Meanwhile, real income growth has flatlined for most households.

What’s notable is the tone. Respondents weren’t angry — they were resigned. Many said they’ve “adjusted expectations,” which is a polite way of saying they’ve given up. That should worry policymakers more than inflation charts or interest rates.

Savings, in theory, are about the future. But when the future looks unstable, the logic of saving breaks down. And so people wait — for a raise, for relief, for something to feel less fragile. It hasn’t come yet.

“When saving becomes a luxury, the future stops feeling like a plan — and starts feeling like a rumour.”