The Week That Shaped the World 16–23 May 2025

1. Trump’s Exit: The Art of the Surrender

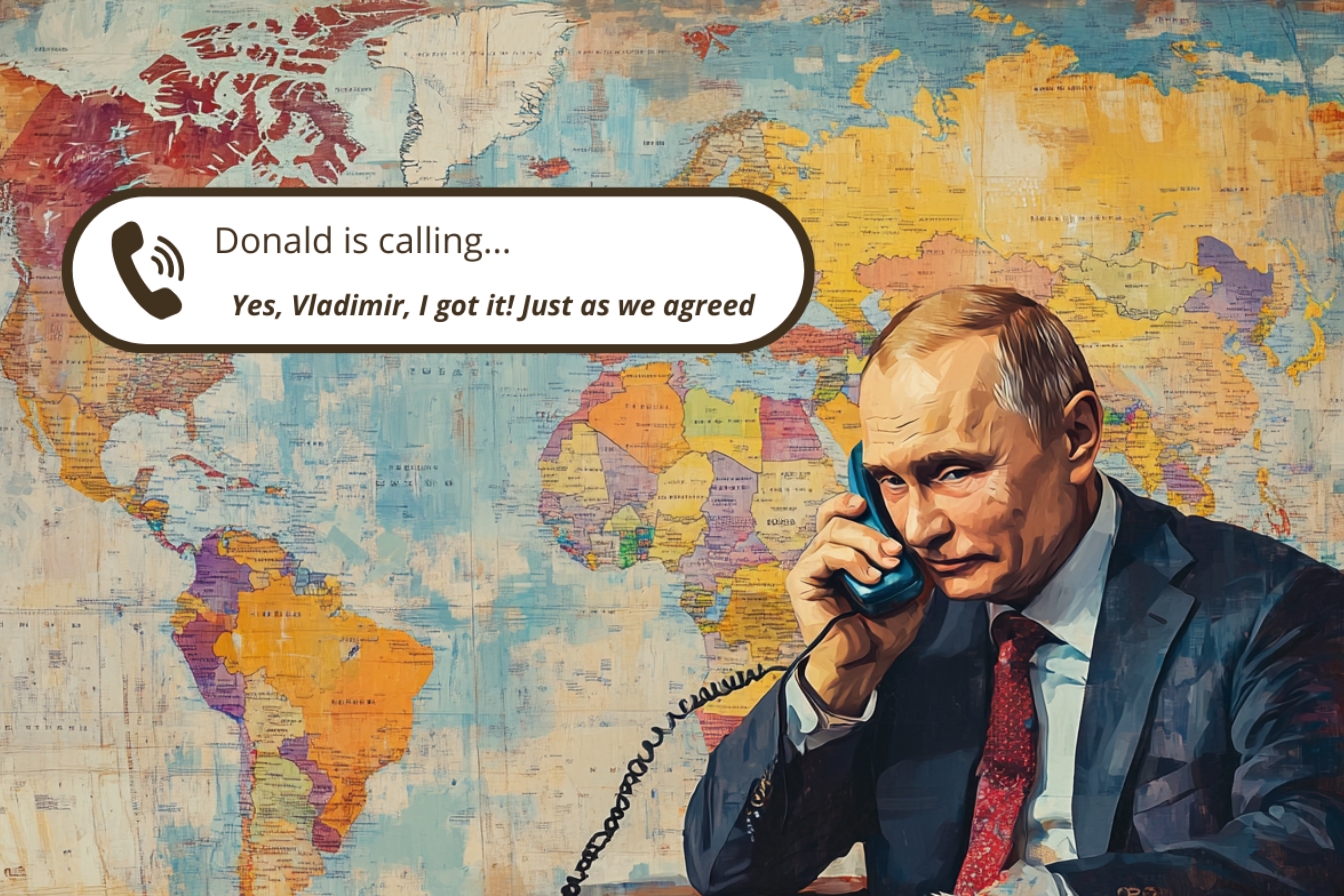

There are moments in history when a man stops pretending. Donald J. Trump, that seasoned performer of bravado, finally laid down his poker face this week and showed his hand. “I think Russia will win this war,” he announced after a cheerful little phone call with Vladimir Putin — a statement so candid it could have been lifted from the Kremlin’s own press kit.

Trump’s withdrawal from the Ukraine mediation effort, self-appointed and entirely unofficial as it was, signals more than personal fatigue. It reflects a broader drift in American foreign policy — one increasingly allergic to entanglements that can’t be monetised, televised, or weaponised for domestic ratings.

What makes this statement remarkable is not the sentiment itself — realpolitik has long whispered what Trump barked. It’s the audacity to declare it aloud, like shouting spoilers in a cinema. With that one sentence, Trump didn’t just exit the stage; he pulled the curtain on America’s façade of neutrality. Ukraine, once hailed as “the frontline of freedom,” is now, if one takes Trump seriously, yesterday’s investment with disappointing ROI.

One could almost admire the honesty, if it weren’t for the shivers it sends through Eastern Europe.

"When a sitting president starts betting on the other side, it’s not diplomacy — it’s a clearance sale."

2. Operation Gideon’s Chariots: Gaza in the Crosshairs

On 16 May, Israel launched what it called Operation Gideon’s Chariots — a name more suited to a biblical vengeance fantasy than a military campaign in a densely populated coastal strip. Over 400 are dead. Over a thousand wounded. And in the background, peace talks in Doha plod along, like a string quartet playing during a building demolition.

This latest offensive, aimed at dismantling Hamas, is Israel’s most aggressive push in Gaza in recent years. Precision airstrikes have levelled blocks. Entire families erased. Hospitals strained. The IDF insists on the surgical nature of the operation, but from street level, it looks more like a chainsaw than a scalpel.

What’s particularly galling is the simultaneity of war and diplomacy. Doha’s conference rooms offer bottled water and platitudes while, back in Gaza, children are pulled from rubble. The disconnect is not new, but it feels especially grotesque this time around. Hamas rockets continue to fly. Iron Dome lights the sky. And the international community scrolls, sighs, and moves on.

The usual condemnations have arrived — strong words, weak wills. Meanwhile, arms contracts are renewed, and alliances recalibrated. The theatre of peace has never looked more theatrical.

"In the Middle East, ceasefires are scheduled like weather forecasts — with zero expectation of sunshine."

3. Germany Sends Tanks East — Again

Germany, with uncharacteristic fanfare, has decided to send its 45th Tank Brigade to Lithuania. Permanently. It’s the kind of sentence that, had it been uttered seventy years ago, would’ve triggered global panic. Today, it triggers press releases, polite applause, and a quiet shuffle in the Kremlin.

Berlin insists this move is about deterrence, not provocation. But one wonders how Moscow reads it. NATO’s Eastern flank now gleams with reinforced steel, and Lithuania — the Baltic minnow — has become a new frontline in a Cold War re-enactment, just with better optics and worse Wi-Fi.

The symbolism here is thick. Germany, long allergic to the scent of its own military ambition, is finally brushing the dust off its tank treads. This isn't the Bundeswehr of old, riddled with bureaucratic inertia and leaky procurement. This is Germany positioning itself as a serious player in European security, or at least trying to look like one.

Critics argue the deployment is more theatre than threat, especially given the brigade’s size. But the message is unmistakable: Berlin is no longer hiding behind Paris or Washington. It’s picking a side, planting a flag, and parking a Leopard tank on the lawn.

"History doesn’t repeat, it reenlists."

4. Mali’s Democracy Buried in a Junta’s Handshake

Mali is once again teaching us that coups are rarely temporary and dictatorships never arrive alone. This week, the military regime formally dissolved all political parties and extended the presidential term until 2030. Why wait for elections when you can simply outlaw your opponents?

Massive protests erupted across Bamako and other cities, met with tear gas, bullets, and — predictably — silence from most Western capitals. Human rights groups issued statements. The junta issued arrests.

Once celebrated for its peaceful democratic transitions, Mali has become a laboratory of repression. What began as a pledge to stabilise the country has morphed into textbook authoritarianism: ban dissent, control the press, and blame foreign influence for local misery.

Africa’s democracies are fragile, but they are also stubborn. Young protesters, some barely old enough to remember free elections, are demanding change at great personal risk. Their resistance may not topple the junta, but it exposes its fear.

And fear, not power, is the real currency of any dictatorship.

"The dictator’s true nightmare isn’t a foreign army — it’s a teenager with a placard."

5. Embassy Bloodshed in Washington’s Shadows

It was supposed to be a quiet diplomatic evening. Instead, it ended in bloodshed. Two Israeli Embassy staff were gunned down outside the Capital Jewish Museum in Washington, D.C. The shooter, reportedly shouting "Free, free Palestine!", is in custody. But the ripples are far from over.

This is not just another mass shooting in America’s catalogue of gun tragedies. It’s an international incident — with overtones of hatred, protest, and unresolved rage. Israeli officials have condemned the act as terrorism. Palestinian advocacy groups urge restraint, fearing the collective backlash.

For Washington, this is a nightmare scenario: domestic instability intersecting with foreign volatility. For Israel, it’s a grim reminder that its conflicts don’t stop at its borders. And for the U.S. Jewish community, already feeling the sharp rise in antisemitic threats, it’s yet another moment of fear and grief.

As always, the question isn’t whether it will happen again, but when.

"Diplomatic immunity doesn’t extend to bullets."

6. Moody’s Warning: America’s Wallet Is on Fire

It finally happened. Moody’s downgraded the U.S. credit rating from Aaa to Aa1. The reason? A ballooning federal deficit now sitting at a breezy $36.2 trillion. That’s thirteen zeros — each one a little prayer to the gods of unsustainable borrowing.

Markets didn’t take the news well. Bond yields spiked. The dollar hiccuped. And Washington — in its usual spirit of bipartisan finger-pointing — did precisely nothing.

The downgrade isn’t just symbolic. It raises borrowing costs, stokes inflationary fears, and casts doubt on America’s global economic stewardship. Worse, it fuels a vicious feedback loop: higher interest payments → bigger deficits → more borrowing → rinse, repeat, regret.

Republicans blame spending. Democrats blame tax cuts. Economists blame both. Meanwhile, the rest of the world watches nervously, wondering how long the dollar can remain the planet’s anchor when the ship itself is creaking.

"When the world’s most trusted borrower loses its rating, you don’t fix the numbers — you fix the addiction."

7. Britain’s Brave 0.1% Upgrade

In an act of optimism only British economists could spin as cheerful news, the UK’s growth forecast was upgraded — from 0.9% to 1.0%. One might expect a national holiday. Or at least a coupon for discounted groceries. Alas, the confetti remains in storage.

This marginal uptick is attributed to a “strong” first quarter, which in practical terms means consumers kept spending, the government kept borrowing, and inflation continued to behave like a drunk in a pub — loud, unpredictable, and prone to knocking things over.

The Bank of England is not amused. Inflation is still above 2%, wages are stagnant, and productivity is sulking somewhere in the 1970s. Yet the Chancellor beamed like a man who’d just discovered a forgotten biscuit in his coat pocket.

In a world of shrinking expectations, perhaps 1.0% is the new miracle. But let’s not confuse movement with momentum.

"If Britain were a patient, 1% growth would be a polite cough, not a sign of recovery."

8. OpenAI Goes Emirati

OpenAI has just inked a $20 billion deal with the UAE’s G42 to build a 1-gigawatt AI cluster — the digital equivalent of building Hadrian’s Wall, but with GPUs. Oh, and they also spent $6.5 billion acquiring a startup co-founded by Jony Ive. Because why not?

The partnership aims to create infrastructure for the next generation of consumer AI devices. Think less “Alexa” and more “ironically charming robot butler who critiques your music taste.”

Critics are already murmuring about data ethics, state influence, and the increasingly weird triangle between Silicon Valley, authoritarian states, and luxury branding. But money has no moral compass, and $20 billion buys a lot of silence.

This deal cements the UAE’s position as a rising AI power. It also suggests OpenAI has fully embraced its corporate adolescence: awkward, ambitious, and a bit in love with its own reflection.

"Nothing says 'open' like partnering with a monarchy."

9. America Works, Inflation Lurks

May’s business activity report from the U.S. looked like a cause for cautious celebration — until one reads the fine print. Growth is up. Orders are rising. But inflation is stretching in the background, like a cat preparing to claw the sofa.

Economists now expect a sharp rise in prices over the next quarter, citing supply chain pressures, wage demands, and the ever-murky Fed strategy that blends economics with divination.

It’s a classic American problem: things are going well, and that’s terrifying. The Fed must now decide whether to squeeze harder or pray inflation goes away of its own accord — which it never does.

Consumers, meanwhile, are starting to notice. Rent is up. Eggs are up. Streaming subscriptions are up. The only thing not rising is patience.

"The economy is working, but so is gravity — and both eventually pull everything back down."

10. Ola’s Electric Dreams, Funded by Bonds

India’s Ola Electric is raising ₹1,700 crore through non-convertible debentures to fund its next expansion phase. In plain English: they’re borrowing big to build bigger — more scooters, more stations, and more attempts at breaking into global markets.

The move underscores two trends: India’s bet on clean mobility and the increasingly creative ways startups finance their growth without diluting equity. Ola’s previous fundraising rounds leaned on venture capital. This one is more old-school: bonds, promises, and a dash of investor faith.

Electric vehicles are booming in India, and Ola stands near the front of that charge. But it’s a competitive field, and execution matters. Scaling production is one thing. Maintaining quality and managing logistics in India’s urban sprawl? That’s a whole different beast.

Still, the ambition is clear: Ola wants to be India’s Tesla — just with more traffic and fewer lawsuits.

"Electric dreams are lovely, but they still need roads, chargers, and a little less smog."