Financing and Loans for Small Businesses in the UK: 2025 Guide

Why getting funded in 2025 feels harder — and where real options still exist

Money worries don’t arrive as line items in your accounts. They arrive at three in the morning, when you’re wide awake, wondering if you’ve got enough to cover wages or rent. I’ve seen it too often: bright ideas going under, not because they were bad, but because the cash ran out before the idea could even breathe.

And here we are, 2025. Interest rates are still biting, banks twitchier than ever, rejection letters flying faster than approvals. It feels hostile. But it isn’t hopeless. This isn’t a lecture. It’s a survival map.

1. Why financing feels tougher in 2025

The Bank of England kept the rates high. That means banks don’t want “dreams”; they want signed orders, invoices, cash in — not cash maybe.

I’ve heard this line too many times: “We’re not rejecting you. We’re rejecting the uncertainty.” Same thing, of course.

2. Government-backed lifelines

The Start Up Loans programme still exists, thank God.

Up to £25k per person

6% fixed

One to five years to pay back

Plus mentoring (and sometimes the mentoring’s the real prize)

Don’t expect a five-minute approval. It takes weeks. But if you can wait, it’s one of the cleanest routes left.

Locally, councils run growth hubs, some offer grants, sometimes even cheap office space. Patchy, yes. Worth a look, definitely.

3. Grants and innovation pots

If your idea smells like “innovation” — tech, green energy, research — then Innovate UK is still your stage. Tough competition, heavy reporting, but winners get real support.

Don’t forget R&D tax relief either. It changed in 2024. If you spend on real research, you can claw some of it back. But you need the paperwork right — HMRC doesn’t do “friendly reminders”.

“A grant isn’t free money. It’s trust. And trust needs proof.”

4. Banks — still there, but tougher

Barclays, Lloyds, NatWest, HSBC… they’ll talk. But don’t expect sympathy. They want numbers that show survival. An overdraft can patch a seasonal hole, but misuse it and you’ll bleed.

Walk in with your worst-case scenario. That’s what convinces them. Optimism never does.

5. Alternative lenders

Fintech’s still quick on its feet: iwoca, Funding Circle, PayPal Working Capital, Stripe Capital. They move fast, decisions in days.

A founder I knew once got money on Friday, spent it by Monday. By month six, repayments had strangled his growth.

“Fast cash feels good. Until it doesn’t.”

6. Scams and traps

Where money flows, crooks follow. Watch for:

“No check” loans from outfits not even on the FCA register.

Fake grants with “processing fees”.

Equity vultures asking half your business for pennies.

Hidden charges — arrangement, early repayment, admin.

Rules are simple:

Check every lender on the FCA Register.

Never pay upfront to “apply”.

Use trusted places — MoneyHelper, British Business Bank.

If it’s not in writing, it doesn’t exist.

I once saw a café owner lose £500 to a phantom “broker fee”. No loan, no refund. Just a bitter lesson.

7. Crowdfunding: not magic, but useful

Crowdfunding looks easy. Post a video, get the crowd’s cash. Sometimes works. Sometimes fails publicly.

Upsides? You raise money and prove demand at the same time. Early backers often become your loudest cheerleaders.

Platforms like Kickstarter don’t take your equity.

Downsides? Campaigns eat months of time and money. Fail, and it’s there online for everyone to see. Equity platforms (Crowdcube, Seedrs) need legal prep, full transparency.

I’ve seen brands explode on Kickstarter. I’ve seen others crawl away, exhausted, with nothing.

“Crowdfunding isn’t finance. It’s theatre. The audience claps… or walks out.”

8. Equity

Sometimes debt doesn’t work. That’s when angels or funds come in.

Crowdcube and Seedrs if you’ve got traction. UKBAA networks if you want angels with cash and scars to share.

But don’t give away your company just to fix a short-term hole. That’s like selling the roof to fix a leak.

| Option | Typical Amount | Cost (APR/Equity) | Speed | Requirements | Main Risks |

|---|---|---|---|---|---|

| Start Up Loan | Up to £25k | 6% fixed | Weeks | Plan + forecast | Limited size |

| Bank Loan/Overdraft | £25k–£250k+ | 5–12% APR | Weeks | Collateral, records | Rejection delays |

| Alternative Lender | £5k–£200k | Higher APR | Days | Sales data | Expensive if prolonged |

| Crowdfunding (rewards) | £5k–£500k | No equity | 1–3m | Audience | Campaign flop |

| Equity (angels/funds) | £50k–£1m+ | 10–30% equity | Months | Pitch deck | Dilution |

Funding in Numbers

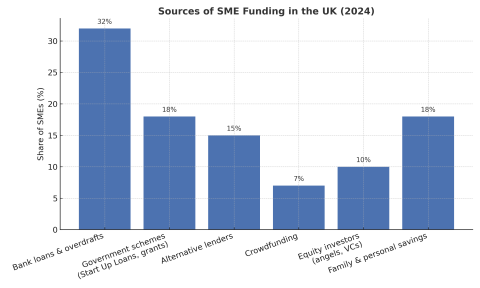

The chart below shows the latest available data on how small businesses in the UK funded themselves.

Figures are from 2024 — official SME finance surveys are always published with a one-year lag, so 2025 results will appear later this year.

Bank loans and overdrafts remain the largest source, while government schemes and personal savings still play a major role.

Crowdfunding and equity are growing, but from a smaller base.

9. Preparing your case

Whatever door you knock on, they’ll all ask the same:

Short, sharp business plan (15 pages max)

Twelve months of cash-flow forecasts

Separate business bank account

Proof of demand — pre-orders, surveys, actual sales

“Ideas don’t get funded. Preparation does.”

10. Case files

Sarah, bakery in Manchester. Bank said no. Start Up Loan said yes. £15k, six weeks of forms, endless re-writes of cash flow.

She hated it. But her mentor nudged her into wholesale. Break-even in eight months.

Omar, fashion startup in Birmingham. Crowdcube target: £120k. Raised £85k. Campaign failed.

But — an angel saw it, invested £90k privately. The “failure” was actually his door opener.

11. Routes that still work

Tiny start (<£10k)? Start Up Loan or small fintech credit.

Tech or green idea? Innovate UK, R&D relief.

Seasonal crunch (£50–250k)? Bank term loan or overdraft.

Consumer brand with buzz? Crowdfunding, if you’re ready for the spotlight.

12. FAQ — the blunt stuff

Q: I’m not British. Can I still get a loan?

A: Only if your visa lets you run a business. If not, forget it.

Q: How fast is a Start Up Loan?

A: Four to eight weeks, unless you sit on your paperwork.

Q: Do I need collateral?

A: Not for Start Up Loans. Banks will want it for big sums.

Q: Crowdfunding money — taxable?

A: Yes, if it’s tied to goods or services. HMRC doesn’t miss.

Q: Can I use grants for salaries?

A: Rarely. They prefer shiny projects over payroll.

13. Mistakes I see too often

Mixing personal and business money.

Submitting without a forecast.

Treating banks as the only route.

Ignoring the free mentoring tied to loans.

“Biggest mistake? Asking for cash before proving you can handle it.”

14. Final thoughts

Funding in the UK isn’t closed. It’s messy, crowded, confusing. But the doors are still open.

Government loans. Grants. Banks. Fintech. Crowdfunding. Angels. They all exist.

They just don’t fund vague dreams.

“Money follows clarity. Make it clear, make it real — and the cash follows.”